In yet another sign that rising income inequality is unsettling our nation, the U.S. Securities and Exchange Commission (SEC) ruled that starting in 2017 most publicly traded companies must identify and disclose how much CEOs make relative to the median salary (middle salary) of rank-and-file employees.

The ruling, also called the “CEO pay ratio disclosure” is meant to increase transparency between companies, stockholders and the public, but opponents of the ruling are claiming that exposing the vast pay discrepancy between CEOs and typical workers is an effort to “name and shame” companies with extremely high-paid CEOs.

It’s no secret that bigtime CEOs make more than their employees, but corporate advocates are loathe to show the yawning disparity – some CEO salaries are more than 2,000 times greater than the median income for the rest of the company’s workforce.

The SEC ruling will expose the wide income disparity between CEOs and their general workers to a broad national audience. That is potentially embarrassing for companies, especially at a time when many working people – some of them employees of the companies in question – can barely afford to make ends meet, let alone maintain quality of life for their families.

What we’re likely to see when companies release their figures is another shocking indicator that despite the fact that Americans are working harder and longer hours, the country’s economy is drastically out of balance, and disproportionately favors those who are already rich by extreme margins.

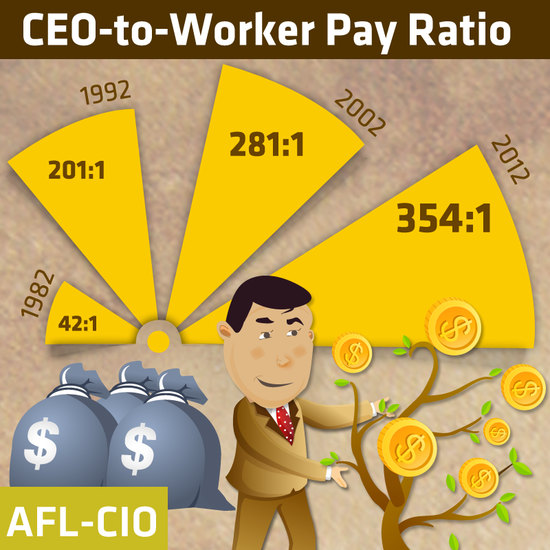

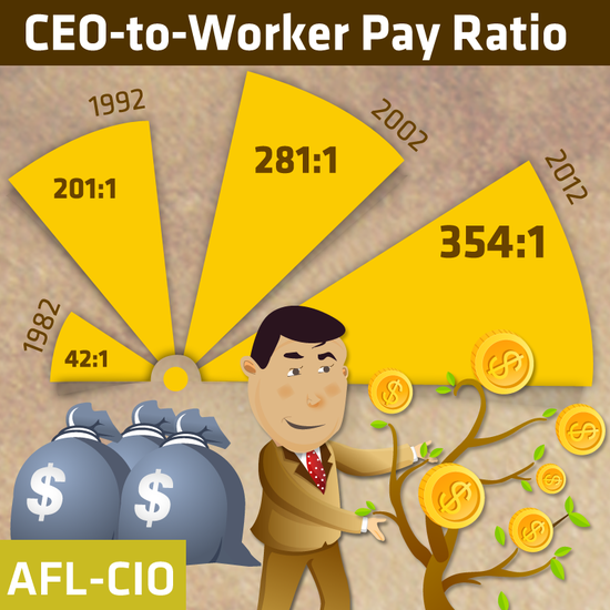

What we already know about the increasing pay gap between CEO pay and their employees is staggering. In the 1950s, CEOs made 20 times more on average than their employees. Today, according to the Economic Policy Institute (EPI), elite CEOs on average make about 300 times more than the typical working person at their company.

While no one expects – or is calling for – general employees to be paid as much as CEOs, a public comparison underscoring the massive pay difference between heads of companies and their employees could ignite renewed debate about how to address the growing income inequality.

Knowing what we know about how collective bargaining levels the playing field for workers by negotiating better wages, joining a union might be a good start. “Unions provide better wages and benefits, job security and a better standard of living,” said AFSCME Pres. Lee Saunders. “Unions have the ability and the track record to rebuild the American middle class and help close the yawning divide between the rich and the rest of us.”