As Congress prepares to vote on a tax plan that would hugely benefit corporations at the expense of working families, a massive leak of documents shows the secretive ways in which large companies, big business owners and other wealthy individuals shelter their wealth from taxation.

OK, we get it: nobody wants to pay more taxes than they have to. But big-name corporations, including Apple and Nike, are creating offshore havens to stash their earnings and avoid having to pay their fair share.

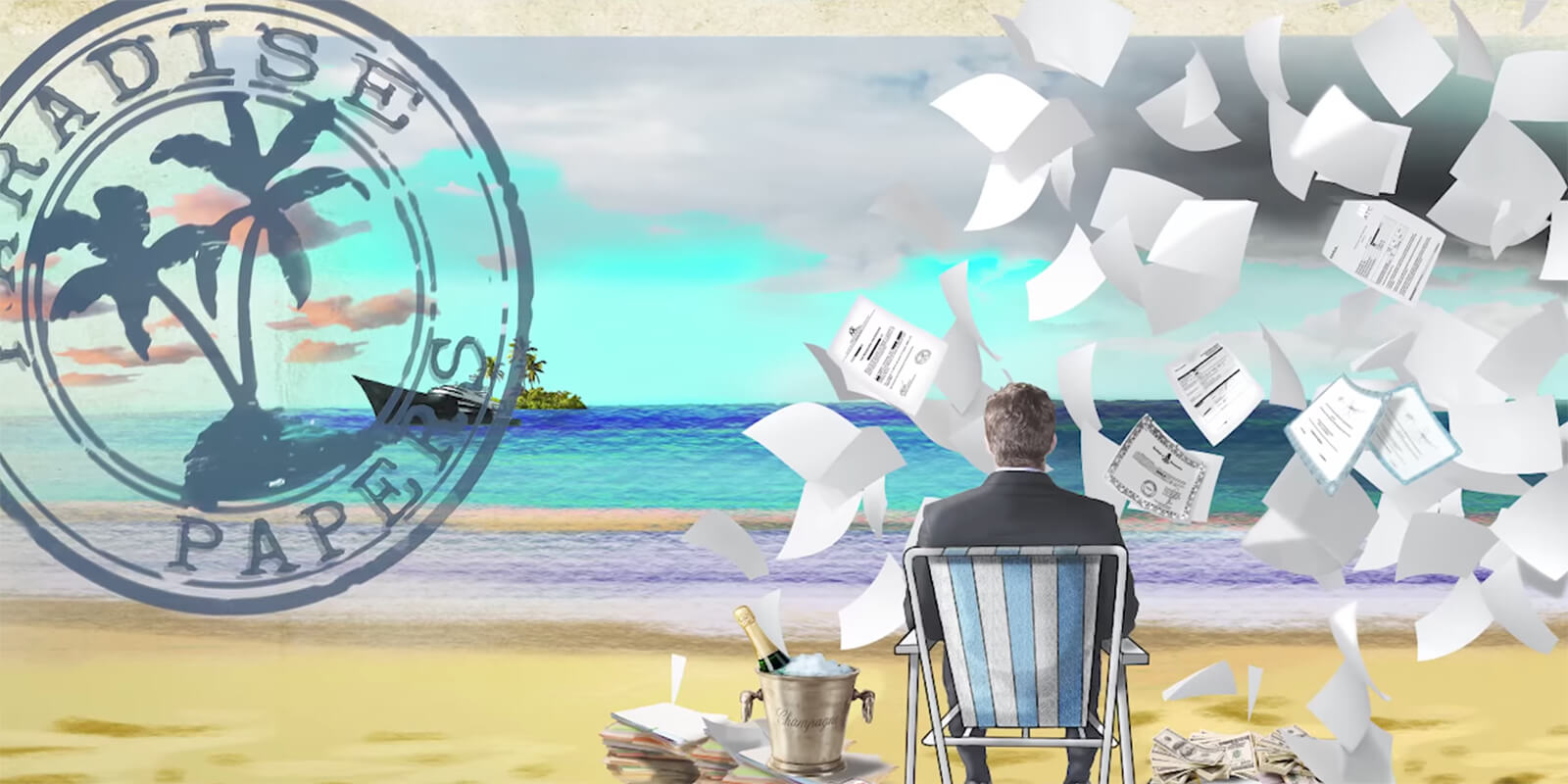

Known as the Paradise Papers, the more than 13 million documents leaked from the Bermudan law firm Appleby are helping to shed light on how giant companies and the wealthy elite go to extreme lengths to exploit loopholes in our tax code, pushing the boundaries of the law in ways that lawmakers – the people’s representatives – never intended.

And yet, congressional leaders, in a hurry to pass a tax plan, seem oblivious to this new information.

The House and Senate proposals would disproportionately benefit the very same entities that are already exploiting tax loopholes to avoid paying all of what they ought to. They don’t need any more help; working families do.

Gary Cohn, the top White House economic adviser, acknowledged just today that the congressional tax plans will be a bonanza for corporate CEOs.

We already knew that the fortunes of the wealthy have been growing much faster than the incomes of working families. Since the Great Recession, the top 1 percent has pocketed some 85 percent of post-recession income growth. The Paradise Papers reveal how the tax plan currently before Congress would only make the situation worse.

AFSCME opposes the House’s tax plan because it’s a giveaway to wealthy corporations and individuals at the expense of working families. The Senate plan is expected to be just as bad. We’ve called on Congress to come up with real tax reform, which would force wealthy corporations and individuals to pay their fair share of taxes, and fully fund quality public services and other vital programs like Medicare and Medicaid.

Before coming up with a tax plan, congressional leaders should stop the myriad and complex ways in which wealthy corporations and individuals rig the system to avoid paying their fair share. Otherwise, Congress will fix nothing in the current tax code and will merely reward those who exploit loopholes for corporate and personal gain.