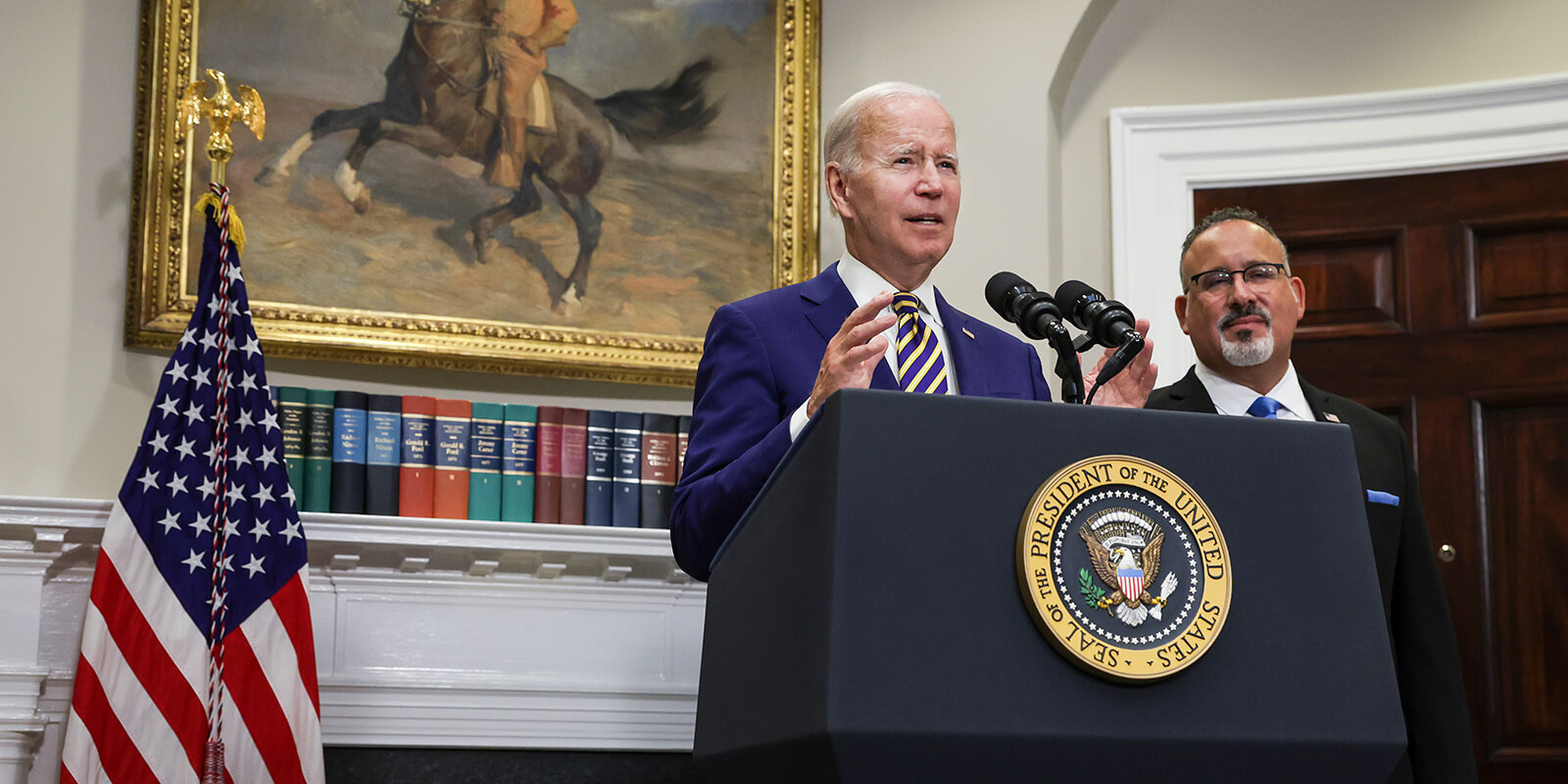

Millions of Americans saddled with crushing student loans got welcome news today from President Joe Biden, who announced a groundbreaking policy that will go a long way in combating the college debt crisis in this country.

Biden announced that his administration will forgive up to $10,000 of college debt for low- and middle-class borrowers who did not receive Pell Grants to attend college, and up to $20,000 for those who received Pell Grants.

This loan forgiveness will be limited to borrowers who earn less than $125,000 per year or households that make under $250,000.

Additionally, Biden announced that borrowers will have until Dec. 31 to begin repaying their student loans; the current deadline was set to expire by the end of this month.

“In my campaign for president, I made a commitment … that we would provide student debt relief. And I’m honoring that commitment today,” Biden said. “People can start to finally crawl out from under that mountain of debt, to get on top of their rent and their utilities, to finally think about buying a home or starting a family or starting a business.”

According to the White House, today’s action would:

- Provide relief to up to 43 million borrowers, including cancelling the full remaining balance for roughly 20 million borrowers;

- Cut monthly payments in half for undergraduate loans and hold schools accountable when they hike up prices;

- Help the most vulnerable borrowers, with nearly 90% of the relief going to borrowers earning less than $75,000 per year;

- Enable the average borrower to save more than $1,000 per year on loan payments; typical borrowers will see loan payments cut in half.

Visit StudentAid.gov/DebtRelief for more information.

AFSCME President Lee Saunders applauded Biden’s new policy.

“For far too long, our national leaders prioritized rich people and corporate interests. Now, working people are finally catching a break,” Saunders said in a statement. “Today’s historic action puts money back into working people’s pockets and frees thousands of families from crippling debt.”

Another aspect of Biden’s overall strategy to lower the student debt burden on Americans involves expanding the Public Service Loan Forgiveness (PSLF) program.

Biden said today he will propose a rule to allow borrowers who have worked at nonprofit organizations, in the military, or in federal, state, tribal or local governments, to receive appropriate credit toward loan forgiveness through the PSLF program.

In October 2021, the U.S. Department of Education implemented temporary changes to PSLF that waived many of the program’s requirements. These changes dramatically increased the number of public service workers eligible for loan forgiveness.

Those wishing to benefit from the waiver must apply before it expires on Oct. 31, 2022. Though the White House says 175,000 public service workers have taken advantage so far, AFSCME has told the Education Department millions more need more time to learn about the PSLF and apply for the relief they deserve.

Saunders said today’s actions on student debt, combined with other Biden administration actions like lowering prescription drug prices, and recent developments like falling gas prices and the lowest unemployment in 50 years are providing a shot in the arm to working families. And, he added, we must continue to fight for further progress.

“For far too long, too many people have barely kept their heads above water, struggling to pay the bills each month,” he said. “With political extremists hellbent on reversing the progress of the last two years and taking away our rights and freedoms, the choices we must make in the 2022 midterm elections could not be clearer.”